straight to your inbox

As a freelancer or the owner of a small business, managing your financial health is not just pivotal—it's paramount to your business's growth and sustainability. One key aspect of this financial wellbeing is credit reporting. However, understanding credit reporting and how it integrates with tools like Expensify isn't always straightforward. In this guide, we’ll delve into the intricate world of credit reporting and help demystify what it means for you and your business.

The Importance of Credit Reporting for Freelancers and Small Business Owners

For small business owners and freelancers, maintaining a strong credit profile is crucial. A robust credit score can affect everything from your ability to secure loans to the interest rates you're offered. It serves as a testament to your fiscal responsibility, lending credibility to your business in the eyes of potential lenders and partners.

Understanding Expensify

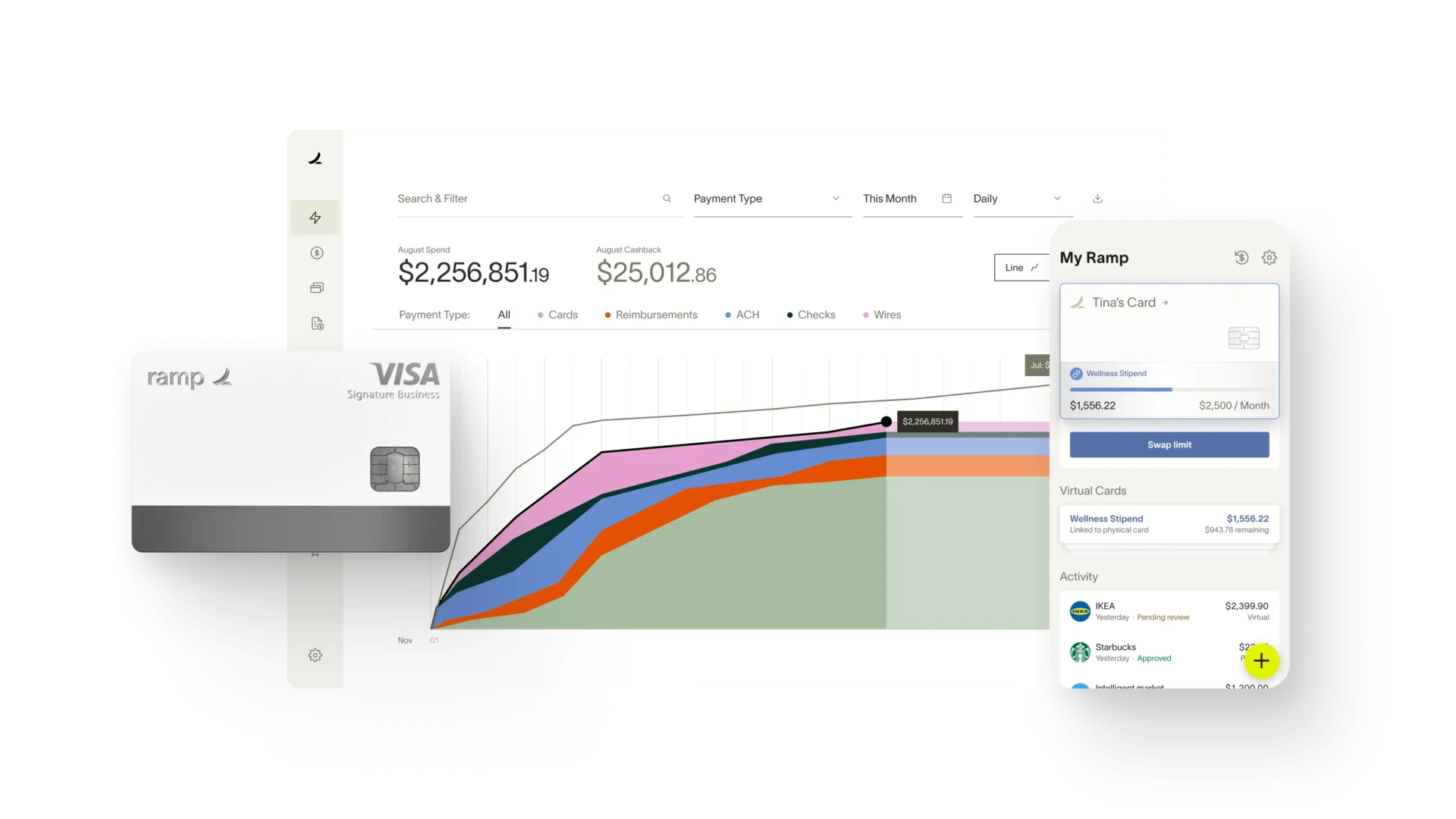

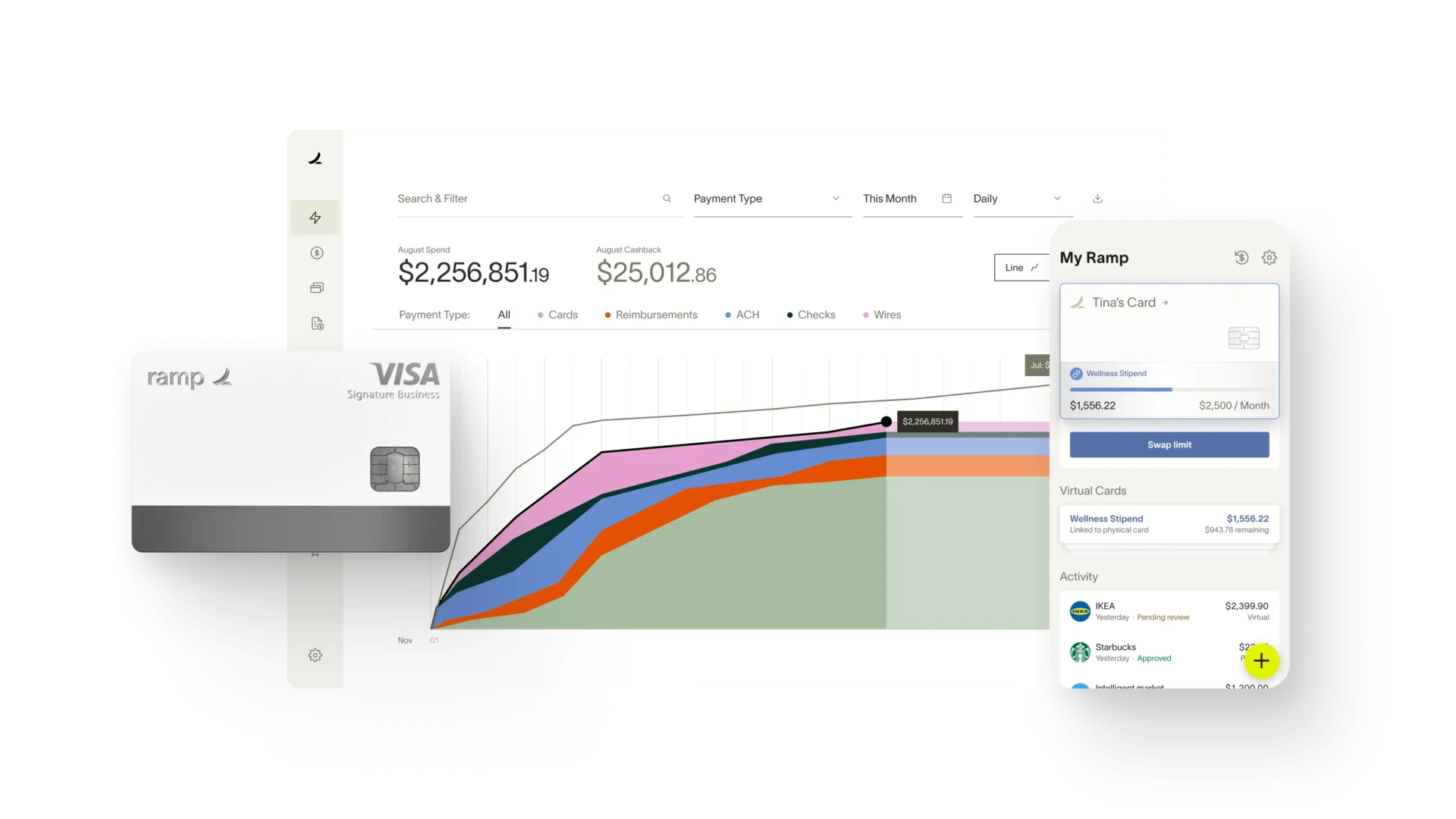

Expensify is an innovative tool designed to streamline and simplify the notorious headache of expense management. It does this by revolutionizing the antiquated process of tracking receipts and managing expenses through features like receipt scanning, automatic expense report creation, and even streamlining global travel.

In the ever-evolving landscape of financial technology, Expensify has carved a niche for itself as a user-friendly, intuitive tool for any business or professional looking to optimize their financial operations.

Credit Reporting Basics

Before diving into Expensify's specific credit reporting practices, it's essential to understand the fundamentals of credit reporting itself. Credit bureaus, or credit reporting agencies (CRAs), are companies that collect and maintain consumer credit information. This information is gathered from various sources, including lenders, creditors, and public records, and then used to compile detailed credit reports for individuals and businesses.

Your credit report reflects your borrowing and repayment history. It contains essential information such as your credit accounts, payment history, account balances, and any collections or bankruptcies you may have. This report serves as the basis for your credit score, which is a numerical representation of your creditworthiness.

Does Expensify Report to Credit Bureaus?

Now, to the crux of the matter: does Expensify report to credit bureaus? The short answer is no. Expensify, as an expense tracking and management tool, does not engage in consumer credit reporting. It is not a lender or a financial institution that traditionally would relay your financial performance to credit bureaus.

Alternative Options for Credit Reporting

Although Expensify doesn't directly report to credit bureaus, this isn’t the end of the road for your credit-building efforts. There are several alternative options and best practices you can explore to ensure you are building and maintaining a robust credit profile:

1. Business Credit Cards

Consider using a business credit card to separate business expenses from personal finances. Many business credit cards report activity to commercial credit bureaus, which can help build a credit history specifically for your business.

2. Deduction Tracking Tools

Utilize tools that help you identify and track tax-deductible expenses. While not a direct line to credit reporting, these deductions can save you money, freeing up cash that can be used to improve your credit by paying down debt or making on-time payments.

3. Loan and Credit Repayment Consistency

Stay vigilant with your repayment behavior. The consistency and timeliness of your payments have a significant effect on your credit score. Even though Expensify doesn't report to credit agencies, tracking your loan and credit card payments can keep your fiscal house in order.

Maintaining financial hygiene is more than just about recording expenses. It's about crafting a narrative of fiscal responsibility that lenders and credit bureaus can interpret. While Expensify doesn't report to credit bureaus, it is one tool in your vast financial toolbox. Leveraging it alongside other strategies, such as smart credit management and utilization of tools that do report to credit agencies, can markedly improve your financial standing.

As a final note, never underestimate the value of education and proactivity in credit management. It can pay dividends in saving you interest on loans and grabbing the attention of potential investors. Take charge of your credit health, just as you take charge of your business. Your future financial self will thank you.