straight to your inbox

Experiencing AMEX fraud Issues? What to do and some alternatives

If you're facing issues with suspected AMEX fraud, quick and decisive action is crucial. Here's a step-by-step guide on how to handle such an unsettling scenario and explore alternatives that could help protect you from future fraud.

Immediate steps to address AMEX fraud

1. Report suspicious activity

At the first sign of any unusual activity on your account or if you notice your card is missing, contact American Express immediately:

- Call the AMEX Security Team at 1-800-528-4800 for immediate assistance.

- For international help, global support numbers can be found here.

- Access the Live Chat for one-on-one support with a Customer Care Professional by logging into your AMEX account.

The AMEX Security Team is available 24/7 to help ensure the safety of your American Express® Card.

2. Secure your online presence

- Regularly review statements for any unapproved transactions.

- Shop only on secure websites, indicated by "https://" and a padlock symbol.

- Enable transaction alerts through SMS or email for real-time updates.

3. Keep your information private

- Never share credit card details unless you initiated contact and trust the entity.

- Generate strong, unique passwords using a password manager.

4. Remain alert to phishing

- Be skeptical of emails or messages that ask for personal or credit card information.

- Regularly monitor your credit report to spot any unauthorized activity.

5. General safety measures

- Always keep your card within sight during transactions.

- Dispose of any documents with sensitive information by shredding them.

- In case of a lost or stolen card, report it to your issuer promptly.

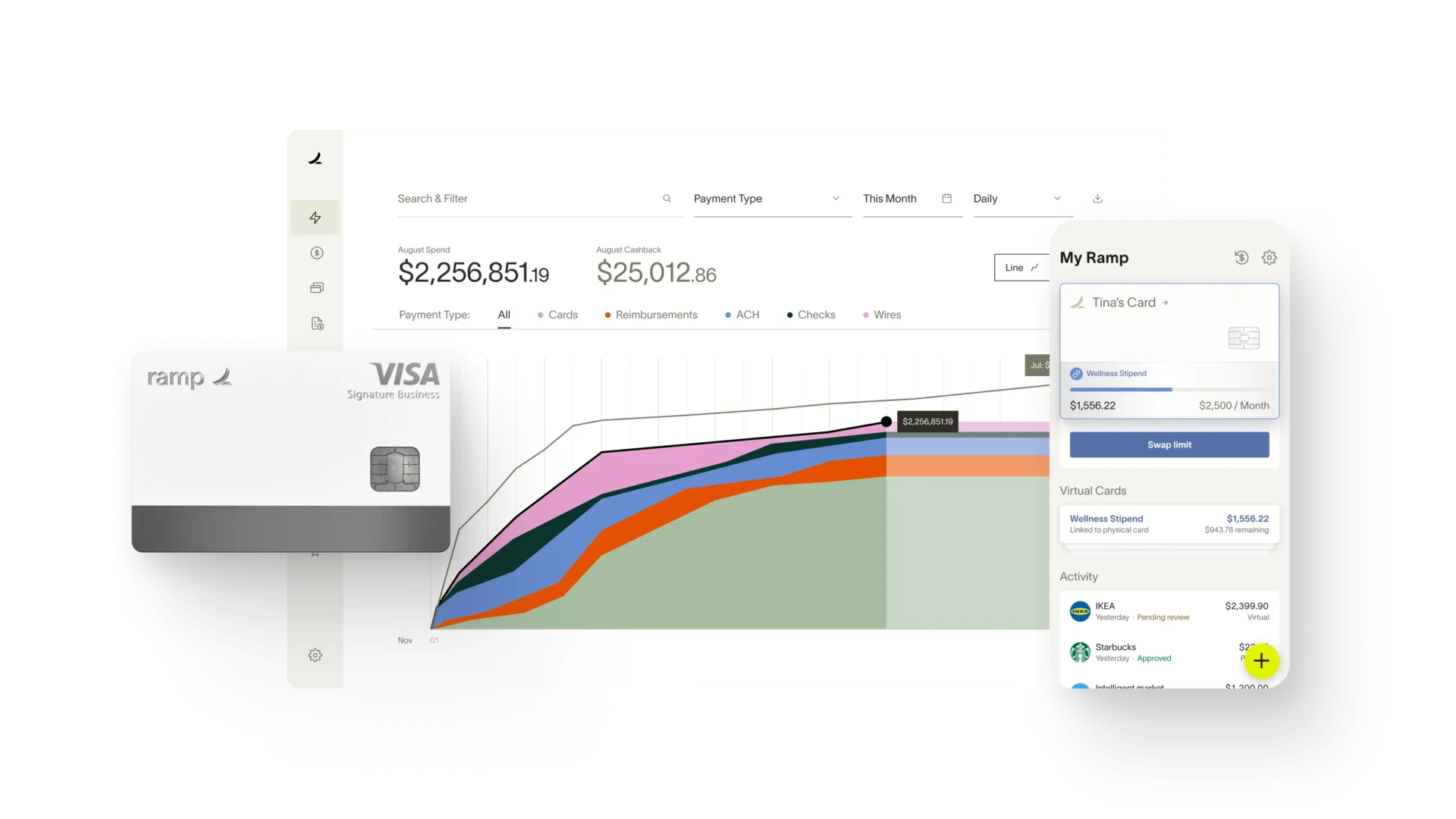

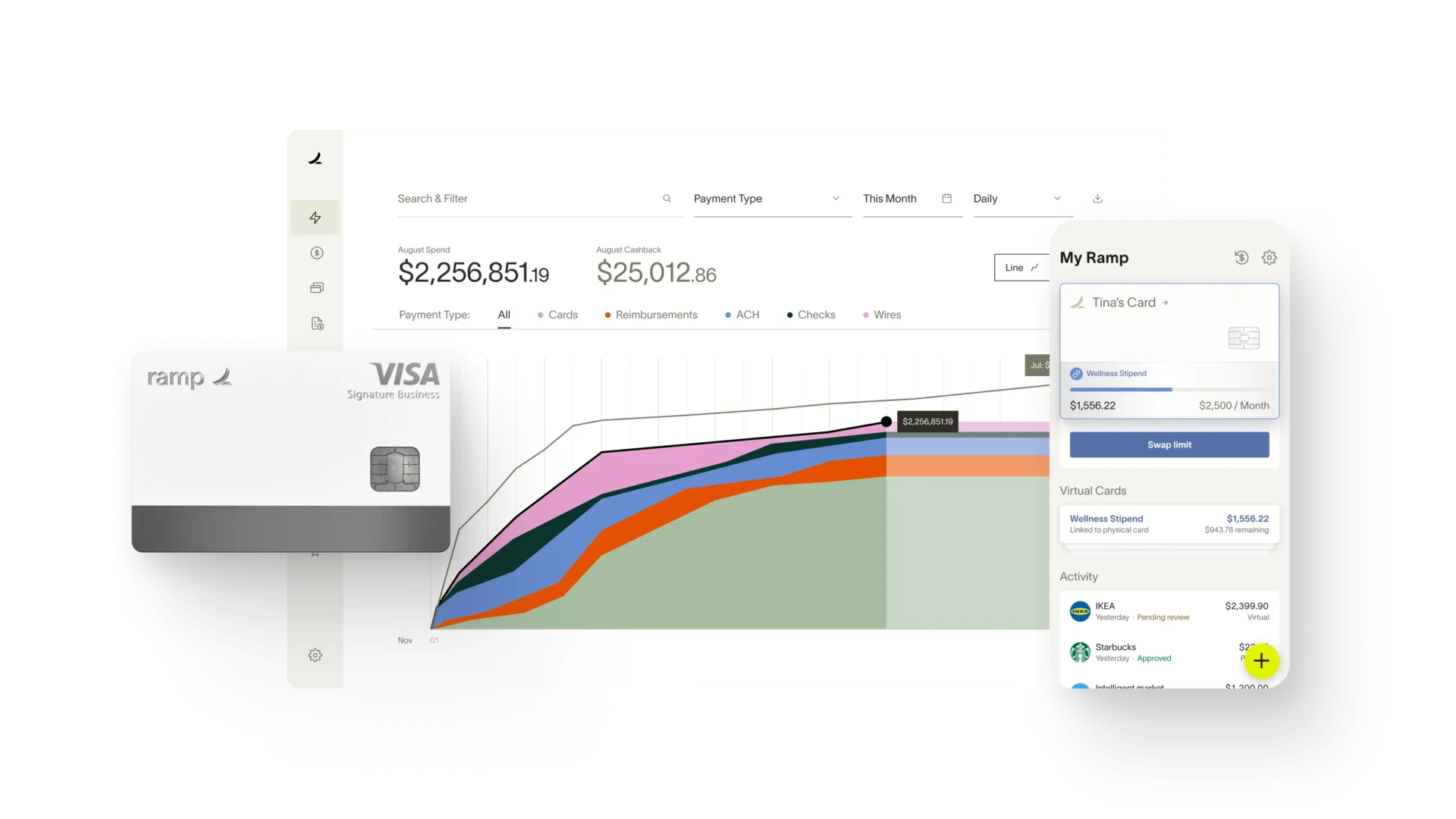

Innovative fraud protection alternative – Ramp

Ramp, a newer player in the market, provides a comprehensive set of fraud prevention tools. While Ramp keeps some of its methods confidential to maintain effectiveness, here are fraud protection features they disclose:

- New account fraud prevention: using third-party identity verification combined with internal procedures to validate users.

- Account takeover defenses: includes multi-factor authentication, risk-based authentication measures, and a monitoring system to track unusual activities.

- Card controls: features allowing users to manage their corporate cards proactively, including merchant and transaction level restrictions.

- Sophisticated monitoring: employing machine learning and proprietary solutions to prevent fraudulent transactions before they occur.

A proactive stance, attention to safe practices, and exploring alternatives like Ramp that offer robust security measures can significantly reduce the risk of credit card fraud. Remember, the key is immediate response and staying educated about potential threats to your financial security.

.jpeg)