Net 30 payment terms: Meaning, examples, and pros and cons

- What are net 30 payment terms?

- How do net 30 terms work?

- When do net 30 payment terms begin?

- Pros and cons of net 30 payment terms

- Net 30 vs. other payment options

- Early payment discounts with net 30 payment terms

- Alternatives to net 30 payment terms

- Best practices for using net 30 payment terms

- Is net 30 right for your business?

- Use Ramp to manage net 30 payments more efficiently

Cash flow challenges often come down to timing: expenses hit now, while customer payments arrive later. That’s where net 30 payment terms come in.

What are net 30 payment terms?

Net 30 on an invoice means a customer has 30 days from the invoice date to pay the full amount owed. It’s one of the most common B2B payment terms, giving sellers a way to stay competitive and buyers extra time to manage cash flow. In accounting, this is often described as a form of trade credit.

For example, if you issue an invoice on March 1 with net 30 terms, payment is due by March 31. Suppliers and service providers in wholesale, manufacturing, and professional services frequently use net 30 to encourage business purchases while giving clients flexibility.

Net 30 is part of a broader set of trade credit terms that also includes:

- Net 15, net 60, net 90: Variations that adjust the payment window based on the agreement

- 2/10 net 30: A discount incentive where buyers get 2% off if they pay within 10 days, but must still pay the full amount by day 30

If you decide to offer net 30, you'll want to assess a customer’s creditworthiness. These terms extend credit without upfront payment, making it important to minimize late payments.

Net 30 vs. due in 30 days

At first glance, net 30 and due in 30 days may seem interchangeable, but they serve different purposes depending on the type of transaction.

While both indicate that payment is expected within 30 days, they differ in how they're used and whether they offer flexibility for your business:

Feature | Net 30 | Due in 30 days |

|---|---|---|

Common use | B2B trade credit | Both B2B and consumer bills |

Clock start | Usually the invoice date but can vary by agreement | Typically the date of billing or service |

Flexibility | Often negotiated | Usually fixed |

Early payment discounts | May include discounts (e.g., 2/10 net 30) to encourage early payment | Typically does not offer early payment discounts |

The key difference is that with net 30, you must clarify when the 30-day clock starts.

For businesses, net 30 payment terms provide trade credit, allowing customers to delay payment without interest. Due in 30 days is more common in consumer transactions and usually follows a stricter, non-negotiable deadline.

Net terms vs. corporate cards

Both net terms and corporate cards give you breathing room on payments, but they work differently. Finance teams often use them together to manage vendor payments and day-to-day spend.

Use case | Net terms | Corporate card |

|---|---|---|

Cash flow | Delays payment per invoice terms | Card cycle float (up to ~30 days) |

Cost | Interest-free if paid on time | May include fees, but rewards and rebates help offset |

Controls | Negotiated terms; late fee possible | Real-time spend controls, fraud protection |

Fit | Standard for vendor invoices | Ideal for SaaS, travel, and online purchases |

How do net 30 terms work?

Net 30 follows four basic steps:

1. Agree on payment terms

Before work begins or products ship, both parties should agree on the arrangement. Document the start date (invoice vs. delivery), any early-payment discounts, and late invoice fees in a contract or purchase order. Written terms prevent misunderstandings later.

2. Create and send the invoice

Your invoice is the official request for payment. Show “net 30” prominently along with the issue date and due date.

Take an invoice dated January 1 with a due date of January 31, for example. If you offer 2/10 net 30 or apply a 1.5% monthly late fee, include that. Send the invoice promptly so the 30-day clock starts on time.

3. Monitor and follow up

Track outstanding invoices and schedule reminders. A friendly nudge a week before the deadline and a direct note on the due date are often enough. Automation helps, but personal outreach can strengthen relationships. Keep a record of communication attempts.

4. Collect payment

If an invoice is outstanding, act quickly. Start with a polite but firm reminder within a few days, apply agreed late fees, and escalate if necessary. For persistent delays, require prepayment or cash on delivery (COD). Only use collections or legal steps as a last resort.

When do net 30 payment terms begin?

The 30-day clock can start at different times depending on the agreement. Always specify the trigger in contracts and invoices to avoid confusion.

- Invoice date (most common): The period begins on the date the invoice is issued. For example, an invoice dated March 15 is due by April 14.

- Delivery or service completion: The countdown begins when goods are delivered or services are finished, even if the invoice comes later. For example, a contractor who completes work on March 10, invoices on March 20, would still expect payment by April 9.

- End of month (EOM): The term begins at the end of the invoice month, regardless of invoice date. For example, an invoice dated March 5 or March 25 would both be due by April 30.

- Receipt of invoice: Some buyers prefer the clock to start when they receive the invoice, to account for postal or email delays. For example, if an invoice is sent March 1 but not received until March 4, payment would be due by April 3.

Why it matters

Different industries lean toward different conventions. For example, software companies often use invoice date, manufacturers may prefer delivery date, and construction firms sometimes tie payment to project milestones. Whatever the approach, spell it out clearly (“Net 30 days from invoice date” or “from delivery”) to reduce disputes and payment delays.

Pros and cons of net 30 payment terms

Net 30 benefits both buyers and sellers, offering greater flexibility in transactions while improving cash flow management. That said, it's not without its drawbacks.

Benefits for sellers

- Attracts more buyers: Offering net 30 makes you more competitive, appealing to customers who prefer flexible payment terms

- Builds stronger customer relationships: Extending trade credit fosters trust, encouraging repeat business and long-term partnerships

- Boosts sales potential: Buyers are more likely to place larger orders when they don’t have to pay the invoice up front

- Manages credit expectations: Clear 30-day terms set boundaries, but sellers still face credit risk. Use credit checks, deposits, and late fee policies to reduce nonpayment.

Benefits for buyers

- Improves cash flow: You receive goods or services immediately, but have 30 days to pay, easing cash flow management

- Simplifies financial planning: A fixed payment window helps you budget and allocate funds effectively

- Provides interest-free short-term credit: You can build business credit to conserve working capital without paying interest on the balance or filling out a credit application

Drawbacks for both sides

- Delayed cash flow: Late or missed payments can strain seller cash flow and create tension with customers

- Risk of missed payments: Tracking and enforcing terms requires admin effort (e.g., follow-ups, reminders, collection efforts)

Net 30 vs. other payment options

Different payment terms affect cash flow and customer relationships in different ways. Here’s how they compare:

Payment term | Meaning | Due date (if invoice is May 1) | When to choose |

|---|---|---|---|

Net 15 | Payment due within 15 days of invoice date | May 16 | When you need faster cash flow or deal with smaller orders |

Net 30 | Payment due within 30 days of invoice date | May 31 | A balanced option and common default in B2B transactions |

Payment due within 45 days of invoice date | June 15 | For larger orders and trusted clients with established relationships | |

Net 90 | Payment due within 90 days of invoice date | June 30 | For enterprise contracts or industries with long approval cycles |

Due in 30 days | Payment required exactly 30 days from invoice | May 31 (if billing date is May 1) | For recurring services or consumer bills where flexibility is limited |

COD | Payment required upon receipt of goods or services | Time of delivery | For new customers, high-risk transactions, or when immediate payment is needed |

Net 30 is the most common middle ground because it’s flexible enough for buyers yet predictable for sellers. Shorter terms improve liquidity but can deter customers, while longer terms may win bigger deals but put more pressure on cash flow.

Early payment discounts with net 30 payment terms

Some sellers offer discounts to encourage early payment. This can improve cash flow for sellers while rewarding buyers for paying ahead of schedule.

2/10 net 30 discount

The most common type of early payment discount is 2/10 net 30, which means:

- Buyers get a 2% discount if they pay within 10 days

- After 10 days, the full invoice is due within 30 days

How to calculate a 2/10 net 30 discount

- Discount amount = Invoice total * Discount percentage

- Discounted price = Invoice total – Discount amount

Example

Let’s say you issued an invoice for $10,000 on March 1 with 2/10 net 30 terms:

- If the buyer pays by March 10, they only pay $9,800 (saving $200)

- If they pay after March 10 but before March 31, they owe the full $10,000 (no discount)

The calculation would look like this:

- $10,000 * 2% = $200 discount

- $10,000 – $200 = $9,800 total payment if paid early

Should you offer early payment discounts?

While early payment discounts can improve cash flow and reduce late payment risks, it can reduce revenue. Ask yourself:

- Can your business afford to give up a small percentage of revenue in exchange for faster payments?

- Do your profit margins and financial strategy support it?

- Would a shorter payment term, such as net 10 or net 15, achieve the same result without a discount?

2/10 net 30 in action

To see how these terms work in practice, imagine ABC Manufacturing, a fictional small business that often waits more than a month to get paid while still covering payroll and supplier bills.

ABC decides to implement 2/10 net 30 payment terms on their invoices. Here's what this means:

- Customers can take a 2% discount if they pay within 10 days

- Otherwise, the full amount is due within 30 days

By offering 2/10 net 30, ABC changes its cash flow profile:

- Example invoice: $5,000

- Paid within 10 days: $4,900 (2% discount)

- Paid within 30 days: $5,000 (no discount)

- Cash flow impact:

- Before: invoice sent January 1; payment received February 15 (45 days)

- After: invoice sent January 1; payment received January 8 (7 days)

- Operational benefits:

- Covered weekly payroll of $3,200 without borrowing

- Paid ≈$8,500 in monthly supplier invoices on time and negotiated better rates

- Never missed the $1,100 equipment lease payment

- Financial trade-off:

- Annual cost of discounts: ≈$3,500

- Interest saved on credit line: ≈$1,200

- Average collection time improved from 38 days to 16 days

The result

After 6 months with these terms:

- ABC's average collection time dropped from 38 days to 16 days

- They eliminated their need for a business credit line

- Late fees from suppliers disappeared completely

- Financial stress decreased significantly because payroll is always covered

Although ABC gave up a small share of revenue, the business gained reliable cash flow, eliminated the need for a credit line, and reduced financial stress.

Alternatives to net 30 payment terms

Net 30 isn’t the only option for managing cash flow. Depending on your margins, customer base, and appetite for risk, you may want faster payment, more flexibility, or outside financing. Below are four common alternatives, each with advantages and trade-offs:

Option | How it works | Pros | Cons | When to use it |

|---|---|---|---|---|

Sell invoices to a third party at 80–90% of value; the factor collects from the customer | Immediate cash flow; offloads collections risk | Fees reduce profit; customers may notice third-party involvement | When you need cash right away and customers are reliable but slow to pay | |

Shorter terms (e.g., net 15) | Require payment within 15 days | Improves liquidity; reduces collection risk | Less attractive to buyers; may limit sales volume | When you prioritize fast cash over customer flexibility |

Longer terms (e.g., net 45, net 90) | Extend payment window beyond 30 days | Attracts enterprise clients; helps win larger contracts | Delays cash inflows; increases credit risk | When targeting big customers that expect extended terms |

Financing (credit line, loan, invoice financing) | Borrow against future revenue or use invoices as collateral | Provides flexibility; keeps customer terms unchanged | Interest costs add up; increases debt load |

Invoice financing or factoring provide immediate liquidity but cut into margins through fees or interest. Adjusting terms is cheaper but shifts how competitive you are in the market. The right choice depends on whether your bigger challenge is cash flow timing, cost control, or customer retention.

Best practices for using net 30 payment terms

Net 30 can improve cash flow for both buyers and sellers, but only if managed carefully. Use these practices to reduce late payments and keep cash flow steady.

For sellers

- Run credit checks before extending terms

- State due dates, start dates, and penalties clearly on every invoice

- Offer early-payment discounts selectively, where margins allow

- Send reminders at set intervals (for example: 7 days before, on the due date, and 7 days after)

- Apply late fees consistently, not sporadically

- Consider deposits or partial prepayment for new or high-risk clients

- Automate invoicing and reminders to reduce admin work

- Use accounting software to track due dates, send reminders, and follow up on unpaid invoices

For buyers

- Confirm with the seller when the 30-day clock begins (invoice date, delivery date, or EOM)

- Plan cash flow so funds are available on the due date

- Take advantage of discounts like 2/10 net 30 when cash allows

- Pay consistently on time to build business credit and secure better terms in the future

Clear documentation, consistent follow-up, and automation make net 30 sustainable for sellers. For buyers, disciplined planning and timely payments strengthen vendor relationships and can unlock better credit options.

Is net 30 right for your business?

Net 30 terms work best when they align with your industry standards and business model. B2B companies often find these terms necessary to compete, while service-based businesses might prefer faster payment cycles.

Consider these questions to determine whether net 30 is a good fit for your business:

- Industry expectations: Do customers in your sector (e.g., wholesale, manufacturing, professional services) typically expect 30-day terms?

- Cash flow capacity: Can you cover payroll and operating expenses while waiting up to 30 days for payment?

- Margins: Do your profit margins support extending short-term credit?

- Customer reliability: Do you trust your clients’ ability to pay on time?

- Growth goals: Are you willing to trade delayed cash flow for higher sales volume or stronger customer relationships?

- Alternatives: Would shorter terms (net 15) or upfront deposits protect your liquidity better?

If you can comfortably wait for payment, offering Net 30 can help you attract and retain clients. If margins are thin or customers are less reliable, stick to shorter terms, deposits, or consider factoring.

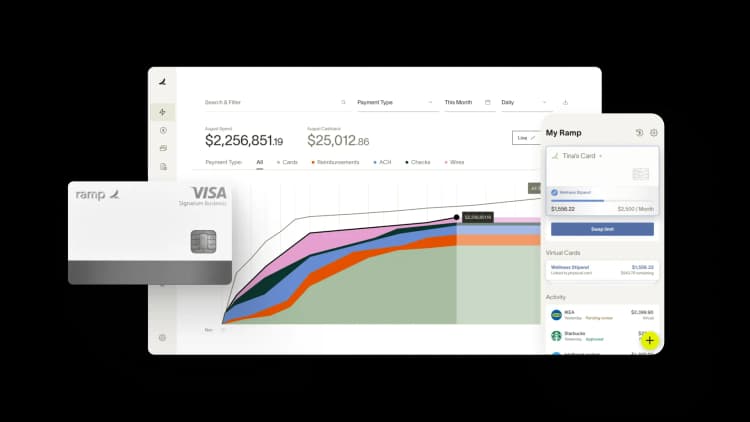

Use Ramp to manage net 30 payments more efficiently

Net 30 terms can improve cash flow and build stronger vendor relationships, but they also come with challenges, such as tracking due dates, preventing late payments, and maintaining cash flow balance. Managing these terms manually can be time-consuming, especially as your business scales.

That’s where Ramp Bill Pay helps:

- Automated invoice processing: Capture, categorize, and approve invoices faster without manual data entry

- Smart payment scheduling: Set up automated payments to avoid late fees and take advantage of early payment discounts

- Real-time cash flow visibility: Get a clear picture of upcoming payments and optimize working capital

By automating AP processes, your business can streamline and manage net 30 terms with confidence, avoid bottlenecks, and strengthen vendor relationships without the back-and-forth of manual tracking.

Try an interactive demo and see for yourself why companies choose Ramp to save time and money.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits