Guide to reducing credit card interest

straight to your inbox

Credit cards are an important funding source for small businesses. They offer quick access to working capital and, if managed correctly, rewards or flexible cashback too. However, credit card interest can cut into those benefits if you neglect it.

In this guide, you will learn what credit card interest is, along with the following:

What is credit card interest?

Credit card interest is the amount you pay the card issuer when you fail to pay back your outstanding balance before the due date. Think of it as the fee you pay for borrowing money from the card issuer beyond the current billing cycle.

Here's how the process works:

- You pay a bill using your small business credit card. You now have an outstanding balance on your card.

- Your card issuer specifies a repayment date. If you repay your outstanding balance before this date, you will not incur interest charges.

- If you fail to pay before the due date, your card provider will add interest charges to your outstanding balance.

To gain the advantage of quick financing and zero interest, you have to repay your balance before the due date. Keep doing this, and your business' credit score improves, giving you access to lower interest rates and better rewards.

Why interest is even more meaningful for small businesses

Credit cards usually carry high interest charges. Federal Reserve Data reveals the average interest rate of consumer credit cards is 15.12 percent as of May 2022. However, this interest rate will likely increase in the current macroeconomic environment due to interest rate increases by the government.

Small business owners should therefore remain cautious of borrowing too much against their credit cards. Fail to pay your balances back on time, and you'll be stuck with interest rates far greater than other funding options. For instance, current SBA loan rates average 9.75 percent (see our SBA loan calculator tool to find the best payment terms for your business).

4 types of credit card interest small businesses should pay attention to

Credit card issuers refer to interest as the Annual Percentage Rate or APR. Many credit card providers offer introductory APRs of zero percent for six to 12 months.

That said, there are different types of interest that small businesses owners will come across as cardholders. Here are the different kinds of credit card APRs:

- Purchase APR: You pay this interest rate on all new purchases you make if you don’t pay your credit card bill on time.

- Balance transfer APR: You can transfer outstanding balances from one card to another. You will pay an interest rate for this privilege called the balance transfer APR.

- Cash advance APR: You can withdraw cash using your credit card. However, you will pay the cash advance APR if you fail to repay the amount before the due date.

- Penalty APR: Some card issuers penalize you with a penalty APR if you carry a balance for too long. This rate is added to your purchase APR.

How does credit card interest work?

Credit card interest is calculated by dividing the APR by the number of days in a year (usually 365) and multiplying that number by your outstanding balance. In short, you accrue interest charges daily if you fail to repay your outstanding balance.

How a credit card’s interest rate is set

Credit card interest rates are either fixed or variable. Fixed rates, as the name suggests, do not change. Variable APRs change based on the value of an underlying index, usually the interest rate set by the Federal Reserve or a country's central bank. This rate is usually called the prime rate.

Here's how credit card companies calculate your credit card's interest rate:

- The card issuer reviews your application, noting your credit score and current debt burden (outstanding business loans, vehicles, etc.)

- The issuer "pulls" your credit report and verifies your payment history, the number of credit accounts, and credit score.

- If the issuer decides to offer you a card, they consider the following:

- If the card's rate is fixed: They set a base APR and add additional APR percentages based on your credit history.

- If the card's rate is variable: They fix the card's base APR a few points above the index rate. They add additional APR percentages based on your credit history.

In short, your credit card's interest rate depends on the prevailing interest rates in the economy and your credit history.

How to calculate your credit card interest

Here are the steps to calculate the credit card interest you will pay over several days:

- Note your APR from your credit card statement. This is the annual interest rate.

- Calculate your daily interest rate. Divide the previous number by 365.

- Multiply your outstanding balance by the daily rate.

- Multiply the previous number by the number of days.

For example, let's assume your credit card's APR is 17 percent, and you have an outstanding balance of $10,000. How much interest will you pay if you decide to repay that balance in 15 days versus 30 days?

- APR = 17%

- Daily interest rate = 17/365 = 0.0465%

- Outstanding balance: Daily interest rate = 10,000 (0.0465/100) = $4.65

- Interest accrued over 15 days = 4.65 * 15 = $69.75

- Interest accrued over 30 days = 4.65 * 30 = $139.50

In this scenario, you’ll pay an additional $69.75 if you clear your balance in 30 days instead of 15. You will incur an additional $4.65 every day you delay repayment.

How to prevent or reduce credit card interest charges

In order to truly leverage the benefits credit cards offer, you’ll want to make sure to avoid paying compounding interest as much as possible. Thankfully there are a few ways to do just that:

Pay fully during the grace period

This is the most simple way to avoid interest entirely: pay your principal balance in full every month.

Every corporate card issuer will give you time to repay your balance before interest kicks in. This period is called the grace period. Most credit card issuers offer grace periods between 20 to 30 days.

Make sure you repay your existing balance fully during this time, and you'll avoid incurring interest charges. You can effectively borrow money for free and use it to grow your business.

Avoid paying the minimum due when the time comes. This monthly payment is just the interest you owe. Your principal stays in place, accruing more interest and increasing your debt.

One way of monitoring your credit card spending is to use a prepaid credit card for business.

Understand interest terms

Credit card interest terms can be confusing. Make sure you discuss all terms with your issuer. For instance, understand how your interest rate will change with a variable rate card. If your issuer offers a 0% intro APR period, note the purchase APR after that time.

Some credit card issuers offer zero balance transfer APRs but ask you to repay the balance within a fixed billing period. Fail to clear the balance, and you'll pay extremely high APRs.

As a rule of thumb, track business expenses on your credit cards and avoid carrying balances. Transfer cash balances only if you understand repayment terms and all the charges involved in the process.

Transfer balances to other cards

Balance transfers to low interest credit cards are a great way to reduce interest charges. For instance, let's say you are carrying $10,000 outstanding on a 20 percent APR card. Your annual interest is (20 percent of 10,000) $2,000.

If you can transfer this balance to a 15 percent APR card (annual interest $1,500,) you'll save $500 annually. If the new card has a zero APR offer that lasts for six months, you will save even more ($1,250).

However, pay attention to the second card's APR terms. For instance, if the zero APR card's purchase APR will reset to 25 percent after the introductory period of time, ask yourself:

- Can you repay the outstanding statement balance before the zero APR period ends?

- If you cannot repay, how much additional interest will you pay thanks to the higher APR?

You’ll also need to factor in balance transfer fees (if there are any).

Draw a loan to pay off credit card balances

If the unpaid balance on your credit card is too high to clear with a single payment, consider drawing a personal or business loan to repay the debt. Note that lenders will consider existing debt before granting you a loan.

Online lenders typically allow you to borrow money to repay credit card debt. Crowdfunded debt is also a good option when you're looking to reduce your credit card interest payments.

Make sure you use the right business budgeting software to project cash flow before making these decisions.

Pay attention to cashback and partner offers

Credit cards can offer you huge rewards when used correctly. For example, many credit cards offer businesses travel and cashback advantages that put money back in your pocket. In some cases, you can use cashback from one card to reduce your interest expenses on another.

However, you must understand credit card interest basics properly before using card features this way. Remember that as long as you repay credit card interest during the grace period, you won't incur interest and can participate in all rewards.

As you can see, interest on a credit card can increase your expenses significantly if you do not pay attention to it. What if you could leverage all the advantages of a credit card without worrying about interest charges?

Ramp: An interest-free corporate card alternative for small businesses

Ramp offers small businesses the best of all worlds. Whether it's simplifying expense management for your employees or discovering savings, Ramp will help you automate and monitor spending.

Unlimited virtual and physical cards

Ramp offers unlimited virtual credit cards for business that are accepted by merchants everywhere. Ramp's software gives you full card management control.

Best of all, you can earn unlimited 1.5 percent cashback with every purchase.

Easy expense controls

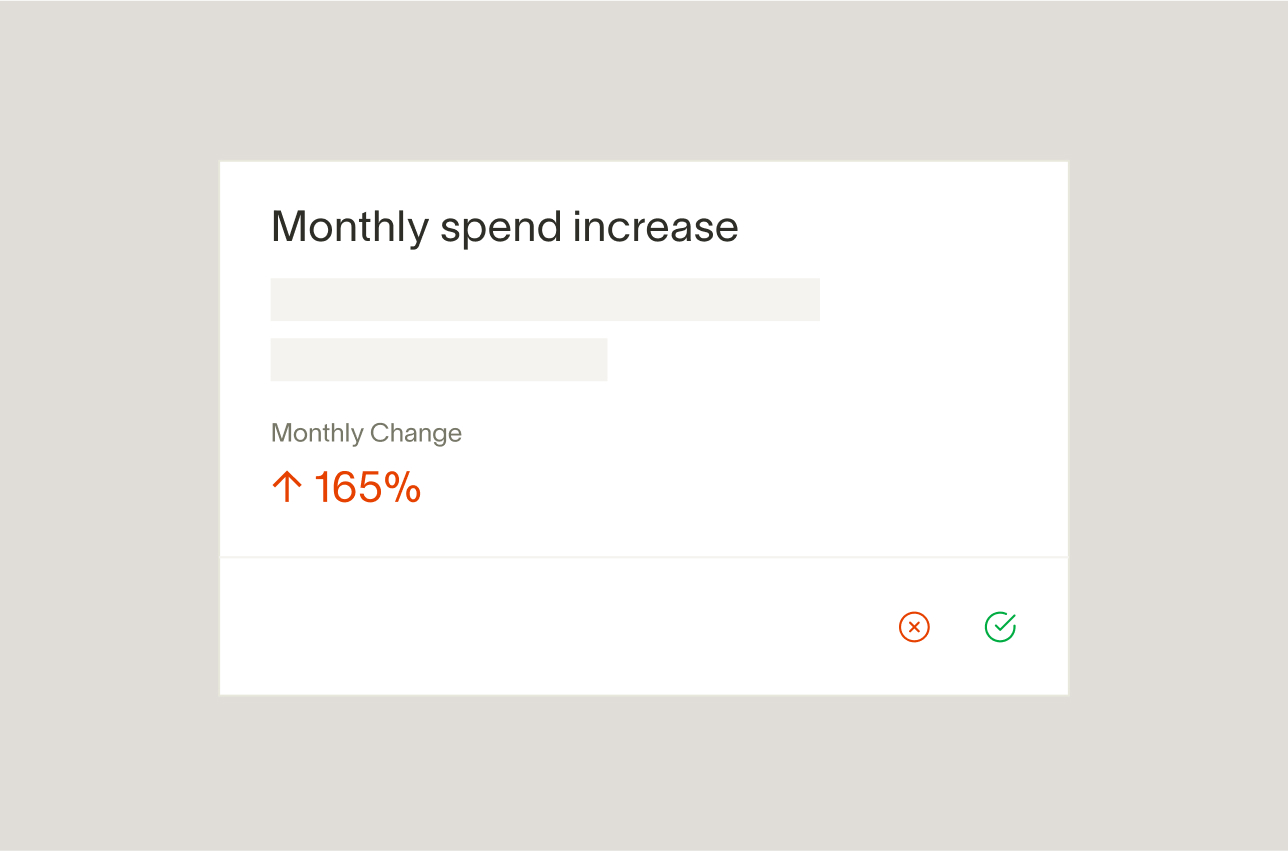

Card spending can get out of hand if you neglect it. Ramp helps you take control of expenses by setting digital policies, whether meals or SaaS purchases, and establish a healthy financial culture in your company. You can reduce expense management workloads by pre-approving expense categories and enforcing spending limits.

Ramp's software flags out-of-policy spending and escalates them for your review automatically. Our AI-powered matching engine reconciles receipts to expenses, whether they're blurred or in a foreign currency.

Seamless accounting

Close your books in one hour thanks to Ramp's automated accounting integrations. Ramp pulls data related to cards, bills, audit trails, and accounting, giving you a quick picture of financial performance.

You can import financial data to popular accounting platforms for small businesses such as Xero, Sage Intacct, Netsuite, and Quickbooks with a few clicks, and simplify balance sheet, income, and cash flow statement creation

Discover savings

Ramp simplifies expense management and unearths savings thanks to pricing intelligence and expense reports. You can prevent common spending errors such as duplicate SaaS subscriptions and unearth shadow IT. Ramp also alerts you to unused partner spending rewards, helping you squeeze more out of your subscriptions.

Thanks to analytics dashboards, you can dig deeper into spending trends and discover potential issues before they cripple you. Ramp's customers unlock savings of 27 percent on average - money that is far more valuable than credit card points.

Credit cards are a good source of small business funding. However, be careful when using them since high interest rates can squeeze your margins significantly. Ramp's virtual cards offer all the benefits of a credit card without the interest and boost your operating budgets and operating profits.

Learn how Ramp streamlines expense management and saves you money.

FAQs

The amount of interest is charged daily on a credit card. Your credit card issuer will divide the APR by 365 to calculate the daily interest rate. Multiply this rate by your outstanding balance to calculate the daily interest amount. The money you owe will increase by this amount daily.

Credit card interest is expressed as an annual percentage called APR. However, it accrues daily. You can pay your outstanding balance at any time.

You can avoid paying interest on your credit card if you settle your outstanding balance before the payment due date.

No, Ramp's business cards do not charge interest.

.webp)

.webp)

.png)