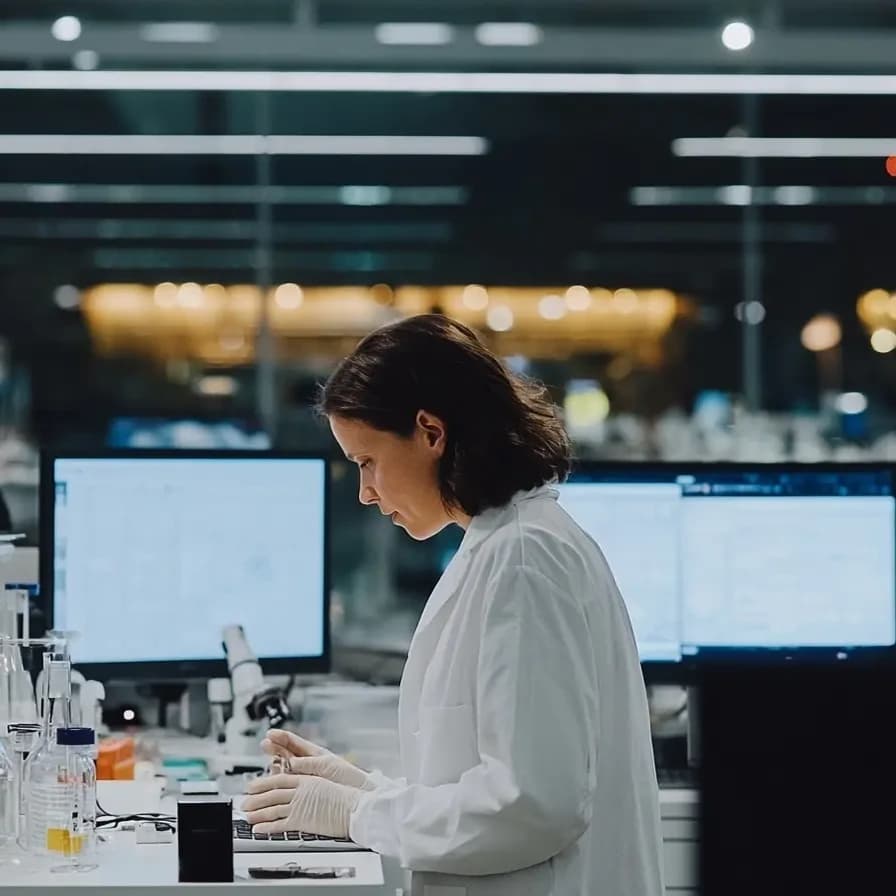

Finance automation for life sciences companies.

Modern finance workflows that match your pace of discovery.

Accelerate breakthroughs with modern finance operations.

Ramp equips life sciences finance teams with real-time visibility, built-in Sunshine Act compliance, and end-to-end procure-to-pay automation.

AI-driven policy enforcement.

Ramp's AI agents ingest your expense policy PDF and enforce rules with full auditability and rationale. They approve low-risk transactions, flag true outliers, and field employee questions over SMS, email, or Slack.

Ramp IntelligenceAutomated intake-to-pay.

Detailed purchase orders with line items, attachments, and quotes automatically generate based on inputs collected from the intake workflow. Two- and three-way match between intake and PO add tighter control and visibility.

ProcurementFaster, more accurate month-end close.

Ramp syncs bills and card charges in real time with your ERP. It auto-codes and categorizes transactions based on policy and past patterns, captures receipts automatically, and reconciles balances with complete audit trails. Close your books 8x faster and remain audit-ready.

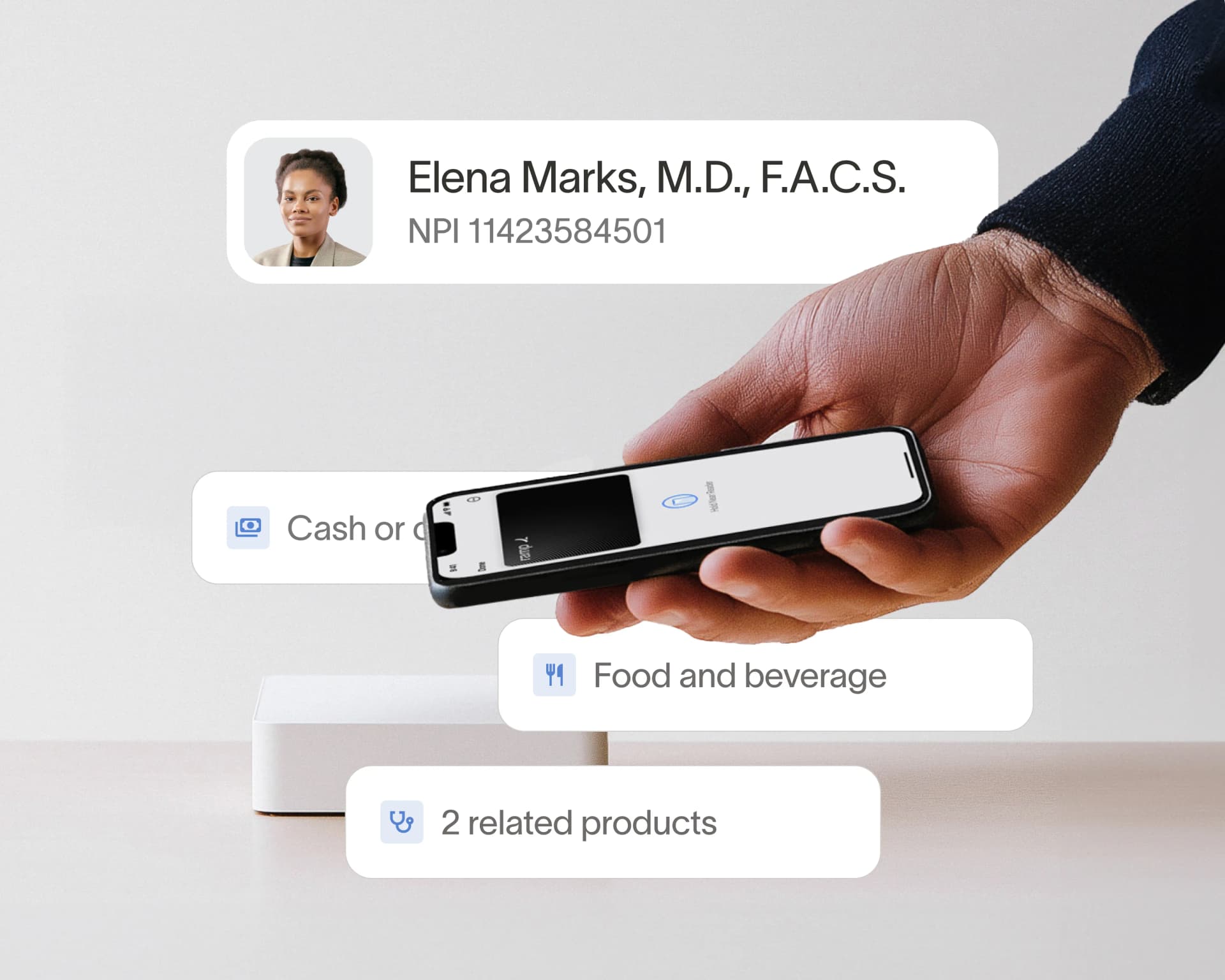

Accounting AutomationBuilt-in Sunshine Act compliance.

Ramp logs HCP spend at the moment it happens. No portals. No pivots. Sunshine tagging is built into every expense, capturing required fields and generating CMS-ready files in one click—so your finance team isn't scrambling come Q1.

Sunshine Act overview

Real-time OPEX tracking.

Monitor R&D, clinical trial, and other critical spend live on intuitive, in-app dashboards. Slice by project, department, or CRO, and then instantly match spend through receipts submitted via SMS, mobile app, or email.

ReportingOur goal is to empower our sales team to build natural, transparent connections with dentists, focusing energy on showcasing how Midas is able to transform their practice. Ramp's Sunshine Act tool is making that possible.

Finance Operations Manager, SprintRay